Learn How To Apply For Tax Compliance Certificate using the enhanced and simplified process of TCC Application on KRA iTax Portal today.

In the past, getting a Tax

Compliance Certificate from the Kenya Revenue Authority (KRA) was

a daunting task, you could wait for days or even months for your KRA Tax

Complication Certificate (TCC) to be Approved or Rejected.

Well, now the long wait for getting Tax Compliance

Certificate has come to an end. Starting this year 2020, this process has been

simplified. Once you apply for KRA Tax Compliance Certificate, you will be

issued with it immediately as long as you do not have any pending returns,

liabilities or payments at Kenya Revenue Authority (KRA).

This is because Kenya Revenue Authority (KRA) has

enhanced the Tax Compliance Certificate (TCC) application process on iTax

Portal to a full self-serviced process managed by the taxpayer. This move is

meant to create efficiency, transparency, and to expedite generation of TCC’s. At

the same time, Kenya Revenue Authority (KRA) has urged all

taxpayers to take full responsibility for their own tax compliance.

According to Kenya Revenue Authority (KRA), iTax

system is now interactive to support the the self-service process, where the

taxpayer applies and get a (TCC) without staff intervention. However, you

need to take note that where there is any outstanding debt, the taxpayer will

need to pay or apply for a payment plan, which upon approval, enables the

taxpayer to continue with the self-service process of applying for Tax

Compliance Certificate on iTax Portal.

So, in this article, I am going to share with you the

simplified process of KRA Tax Compliance Certificate application on iTax. Before

we proceed any further, we need to understand what we mean by Tax Compliance

Certificate.

What Is Tax Compliance Certificate?

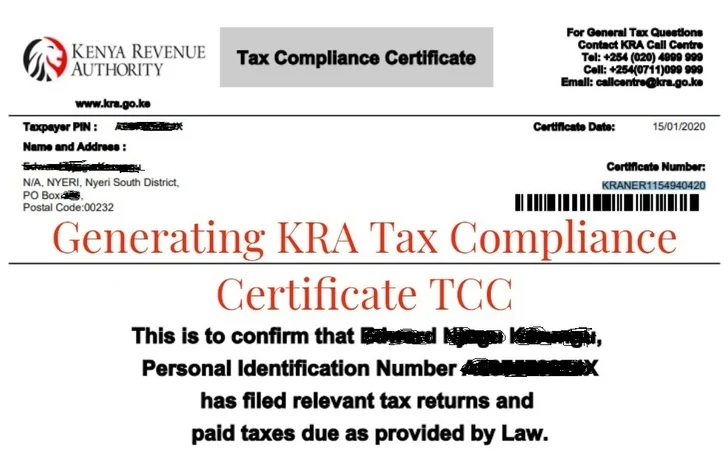

Tax Compliance Certificate is a document issued by Kenya

Revenue Authority (KRA) to taxpayers who have complied and filed their tax

returns for a specific period and paid all taxes due as provided by Law. The

KRA Tax Compliance Certificate is valid for a period of 12 months from the date

it has been issued to a taxpayer.

Being compliant means that you have no pending liabilities

with Kenya Revenue Authority (KRA). In simpler terms, compliant means you don’t

owe KRA anything in terms of unpaid taxes. So, when you are compliant,

something that Kenya Revenue Authority (KRA) wants all taxpayers to be, then

applying for a Tax Compliance Certificate (TCC) will be a walk in the park. You

will be able to get the TCC in less than 3 minutes of application.

If you are tax compliant, then KRA will issue you with a Tax

Compliance Certificate (TCC) immediately you have finished applying for it on

iTax. If you are not compliant, then KRA will give you the details of the

pending returns and liabilities i.e. the years that you did not submit your KRA

Returns and the years you have not paid for the liabilities accrued. Now, let’s

looks at the simplified process of KRA Tax Compliance Certificate application

in 2020 and going forward.

Tax Compliance Certificate Application Requirements

Before we start on the simplified process of TCC

application, you need to have the following two requirements with you before

you can proceed.

- KRA

PIN Number

The first thing that you need to have with you is your KRA PIN Number. If by

any chance you have forgotten or you don’t remember your KRA PIN, you can

submit KRA PIN

Retrieval order online here at Cyber.co.ke

Portal and our team of experts will be able to assist with with PIN Retrieval request.

- iTax

Password

The next item that you need to have with you is your KRA

iTax Password. You will need the iTax Password to access your KRA iTax Account. Once you have requested for password reset, a new

password will be emailed to you and you can use it to log into your iTax

Account.

How To Apply For a Tax Compliance Certificate

Step 1: Visit KRA iTax Portal using https://itax.kra.go.ke/KRA-Portal/

The first step that you need to take is to ensure that you

visit the KRA iTax portal using the link provided above in the title.

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. Once you have entered your KRA PIN,

click on the “Continue” botton to proceed to the next step.

Step 3: Enter KRA iTax Password and Solve Arithmetic

Question (Security Stamp)

In this step, you will be required to enter your KRA iTax

Password and also solve the arithmetic question (security stamp). A new password will be sent to your email and you

can use it to login. Once you have entered your iTax Password, click on

the “Login” button to access your iTax Account.

Step 4: iTax Account Dashboard

Once you have entered the correct iTax Password as

illustrated in Step 3 above, you will be able to see and access your iTax

Account Dashboard.

Step 5: Apply for Tax Compliance Certificate (TCC)

In this step, you will need to click on the certificates

tab, then you click on the “Apply for Tax Compliance Certificate (TCC)” from

the dropdown menu. This is as illustrated in the screenshot below. Now, you

begin the process of TCC application.

You will take note that with this new enhancement, a popup

window will be display as shown in the image above saying: “Please be

informed that you are entitled for the Tax Compliance Certificate (TCC) without

any workflow. Please click OK to continue.”

In simple terms, this simply means that if you choose to

apply for the Tax Compliance Certificate, it will be issued to you immediately

i.e the TCC Application will be Auto Approved by the iTax System. Click OK and

proceed to filling in the Reason for Application. In our case, we need this Tax

Compliance Certificate for Job Application process.

Once you have filled in the reason for Tax Compliance

Certificate application, click on the “Submit” button to submit the application

request to Kenya Revenue Authority (KRA).

Step 6: Download Tax Compliance Certificate

This is the last step whereby you will need to download the

Approved Tax Compliance Certificate. You will also need to take note of the

approval receipt for the KRA Tax Compliance Certificate that also has an

acknowledgement number associated with it.

Once you have downloaded the KRA Tax Compliance Certificate,

you will be able to make copied for future uses when it will be needed. Also

you need to take note that the TCC is only valid for a period of 12 months from

that date it was issued.

Group of Taxpayers Entitled To Get Tax Compliance

Certificate (TCC) Immediately Upon Application

So, the KRA TCC will be issued to any taxpayer who has filed

and complied with the tax laws in Kenya. The group of people whom when they

apply for KRA Tax Compliance Certificate will be issued immediately in 3

minutes includes:

- New

Taxpayers i.e those who have just gotten their new KRA PINs.

- Compliant

Taxpayers i.e those who have filed relevant tax returns and paid taxes due

as provided by Law.

In this case, if you don’t fall under the above two

categories of taxpayers, then the chances of you getting the Tax Compliance

Certificate as very slim to nothing. Let me explain with an example.

Group of Taxpayers Not Entitled To Get Tax Compliance

Certificate (TCC) During Application

This is the group of taxpayers who cannot apply for Tax

Compliance Certificate on iTax. This comprises of the following two categories

of taxpayers:

- Taxpayers

with Pending Returns i.e those who have not filed their KRA Returns for a

certain year(s) on iTax.

- Taxpayers

with Pending Payments i.e those who have not paid tax liabilities or

penalties on iTax.

Assuming you have an active KRA PIN and need a Tax

Compliance Certificate either for Job Application or even Tender Application in

Kenya, you head over to iTax Portal and follow the steps that we have just

shared above. Knowing that you have never filed any KRA Returns or forgot to

file for a certain year? What will happen.

When you try to apply for TCC in the enhanced system, you

will see a popup as shown above with the message: “Please note that you

cannot apply for TCC as you have pending return/payment to be filed or

liability to paid. Please click OK to view the details of pending

returns.” The message simply means that you did not file your KRA

Returns for a certain year and you will need to file those pending returns

before trying to apply for a Tax Compliance Certificate again.

At the bottom of the same page, you will see a box with the

title “Details of Pending Returns” You will need to click on

the Details of Pending Returns -ITR (Income Tax Resident) to view the pending

returns for the years not filed.

So, in this scenario this taxpayer will have to file all

those pending returns on iTax before trying to apply again for a Tax Compliance

Certificate. Filing of those pending returns is the the final step as there

will be a penalty that will be imposed as a result of late filing. The taxpayer

can choose to apply for KRA Waiver and if “Approved” proceed to apply for the

TCC.

In case the waiver application is “Declined” then the

taxpayer will have to pay those pending penalties as they form part of the

liability preventing him/her from applying and getting the Tax Compliance

Certificate. With this new enhance on the process of TCC Application, I can

definitely give a thumbs up to Kenya Revenue Authority (KRA).

Why? In the past (previous years) when you applied for Tax

Compliance Certificate on iTax, you had to wait for a KRA Officer to go through

your tax ledger to see if you have any pending returns or liabilities. This

process could take days or even to some extent months. But now with this new

enhancement on the Tax Compliance Certificate application process, this has

been simplified as you will get a popup notice telling you whether you can

apply or not apply for a KRA Tax Compliance Certificate.

So, next time you need to apply for a Tax Compliance

Certificate (TCC) just follow the above steps and get your TCC within minutes

of application.